michigan property tax rates by township

2019 Millage Rates - A Complete List. The list is sorted by median property tax in dollars by default.

County Of Midland Michigan Equalization Tax Maps Hope Township

Rate is 186 mills for portion of township in River Valley schools 53538.

. Invest Township funds in approved investment vehicles. For existing homeowners please enter the current taxable value of your property. 2020 Millage Rates - A Complete List.

Ada Township had a total taxable value of 986136828 in 2018 of which 81 is residential property. The PRE is a separate program from the Homestead Property Tax Credit which is filed annually with your Michigan Individual Income Tax Return. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

Macomb County has one of the highest median property taxes in the United States and is ranked 218th of the 3143 counties in. This can be obtained from your assessment notice or by accessing your tax and assessing records on our Property Tax Search website. Michigan case law has long drawn a distinction between ad valorem taxes and traditional special assessments.

Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided. The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000. You can sort by any column available by clicking the arrows in the header row.

50 East VW Avenue Vicksburg MI 49097. Please be sure to include the bill number or the property tax ID number on your check so that we may be sure to credit the right property. Median Annual Property Tax Payment Average Effective Property Tax Rate.

You can also estimate the summer or winter taxes separately. Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. 33215 Waverly of Total.

Township PoliceFire 2 05561. To claim a PRE the property owner must submit a Principal Residence Exemption PRE Affidavit Form 2368 to the assessor for the city or township in which the property is located. 2017 Millage Rates - A Complete List.

For more details about the property tax rates in any of Michigans counties choose the county from the interactive map or the list below. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator. Send your check money order to.

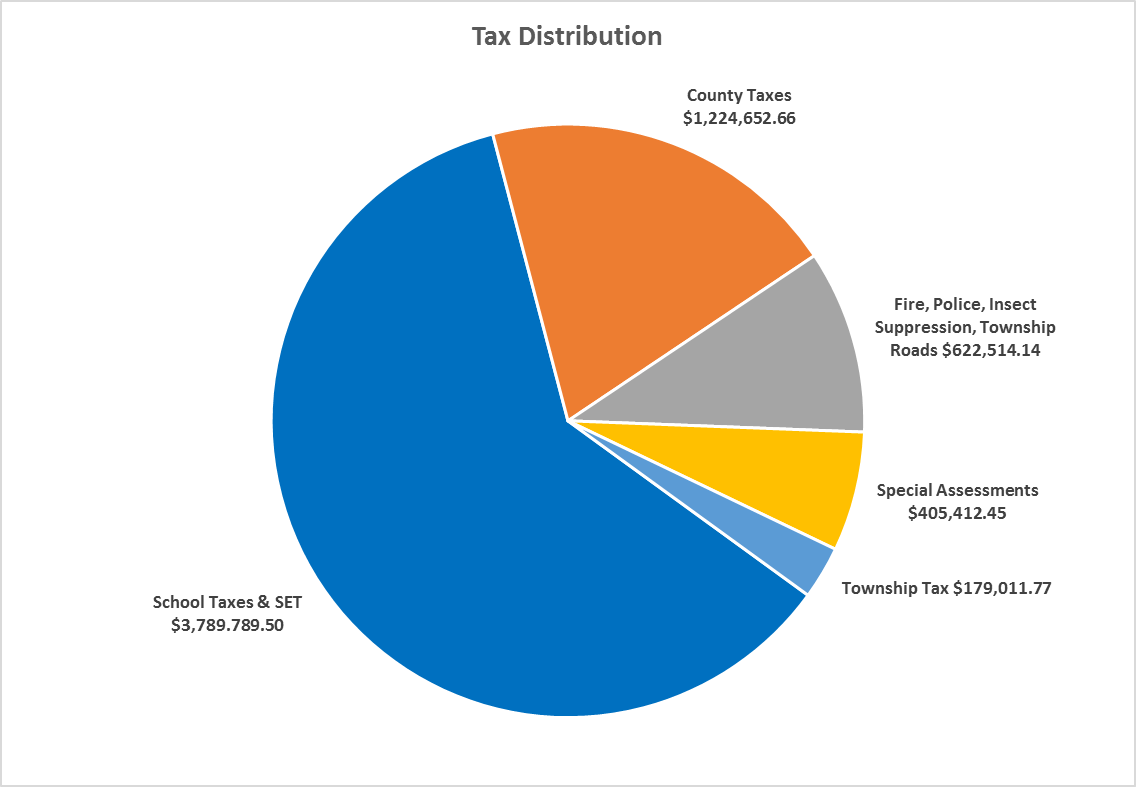

Real and personal property taxes are the combined total of school taxes local intermediate community college and state education library county taxes operating and 911 county transit and township taxes. You can click the More Information link to. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected.

Macomb County collects on average 174 of a propertys assessed fair market value as property tax. January 1 - December 31. Chesterfield Township 47275 Sugarbush Road Chesterfield MI 48047.

But just in case there are times when inflation and home prices sky rocket in. Then the local unit must impose a property tax administration fee at a rate equal to the rate of the fee imposed for city or township taxes on that parcel unless there. Please do not submit cash through the drop box.

See for example Graham v City of Saginaw 317 Mich 427. 2018 Millage Rates - A Complete List. Uncover Available Property Tax Data By Searching Any Address.

Winter Tax Rates. 2015 Millage Rates -. January 1 - December 31.

Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 254610 434610 194610 314610 254610 434610 MUNISING PUBLIC SCHOO 274610 454610 214610 334610 274610 454610 SUPERIOR CENTRAL SCH 310495 490495 250495 370495 310495 490495 Burt. Monday - Friday 800 AM - 430 PM. 2021 Millage Rates - A Complete List.

The highest rate is 815 mills in River Rouge cityRiver Rouge schools in Wayne County. Canton Township Treasurer PO. For new homeowners please contact the.

This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and percentage of median income. The deadline for a. 2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

33070 Holt of Total. Average 2016 taxable value of a residential parcel. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

You will then be prompted to select your city village or township along. Township PoliceFire 1 16147. Total taxable value per capita is 67878 based on a population of 14528 residents.

Median property tax is 214500. We are open Monday through Friday from 830 am to 430 pm. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

Average 2016 true cash value of a residential parcel. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County. 1 day agoWe spoke to her about how your rates are set that taxable value is half of the market value.

Ad Find Out the Market Value of Any Property and Past Sale Prices. 2016 Millage Rates - A Complete List. The school district your property is located in determines the annual millage rates applied to calculate the taxes on your property.

State Summary Tax Assessors. January 1 - December 31. For 2020 the summer millage was 255133 and the winter tax millage was 50060.

For a property with 250000 True Cash Value TCV and 125000 SEV it would be multiplied by 0305193 for an estimated tax of 381491. 84 rows Minnesota. Michigan Department of Treasury Property Tax Web Portal.

You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Maintain accurate records of all income receipts and disbursements. 33020 Lansing of Total.

Collect and perform jeopardy assessments on personal property taxes. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with. The lowest property tax rate in the state is 162 mills in Leelanaus Cleveland Township within the Glen Lake school district.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

Frequently Asked Questions About The Public Safety Millage Pittsfield Charter Township Mi Official Website

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

Tax Bill Information Macomb Mi

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

Property Taxes Inland Township Benzie County Michigan

2022 Best Places To Buy A House In Michigan Niche

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com

The 44 Communities With Lowest Property Tax Rates In Michigan Mlive Com